Short selling Indices On Etoro

Short selling Indices On Etoro , In this Post , i will explain how to open a Short Position in Indices on Etoro platform

Note : Shorting , is risky , please be sure to do your homework and technical Analysis before opening a Short position.

What is Short Selling Indices?

When you open a Short Position in Indices, you are expecting Stock Market Indices to drop in later Period.

Short Selling Indices means you borrow ” x “number of unit s Indices Contract from the Broker ( Etoro ) and then Sell It at market Price.

What are the Risks ?

- When the Indices rise , you will loose money

- Price action might happen too fast , and swoop pass your Stop Loss amount

- Price Action Direction can always reverse due to any news catalyst

Short selling Indices On Etoro ( Lets get Started )

Step 1

Do your Home Work , do your Technical Analysis ,

(1) Draw your trading Plan

(2) At what Price you will take profit

(3) At what Price you will Stop Loss

Step 2

Starting from Step 2, Base on your trading Plan , we will step through on how open a short position

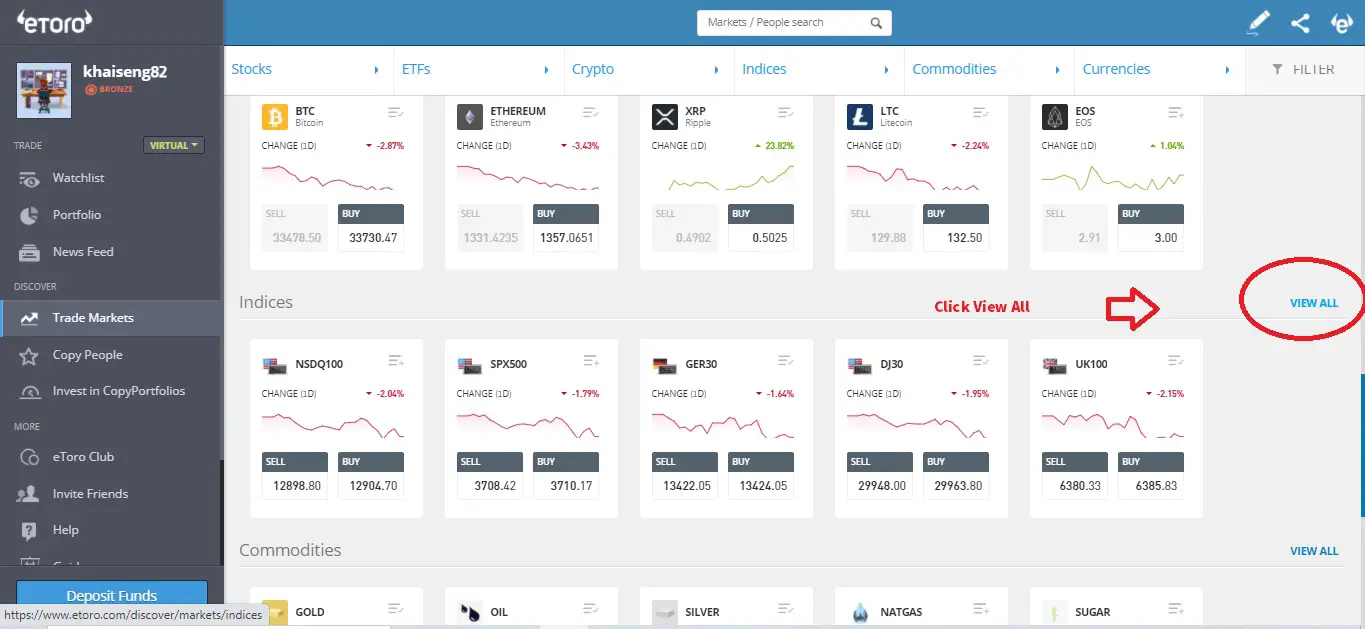

(1) After Signing Up your Etoro Account , login to your Etoro Account and Click Trade Market

(2) At your Right Hand side Screen navigate to Indices and click view all

Step 3

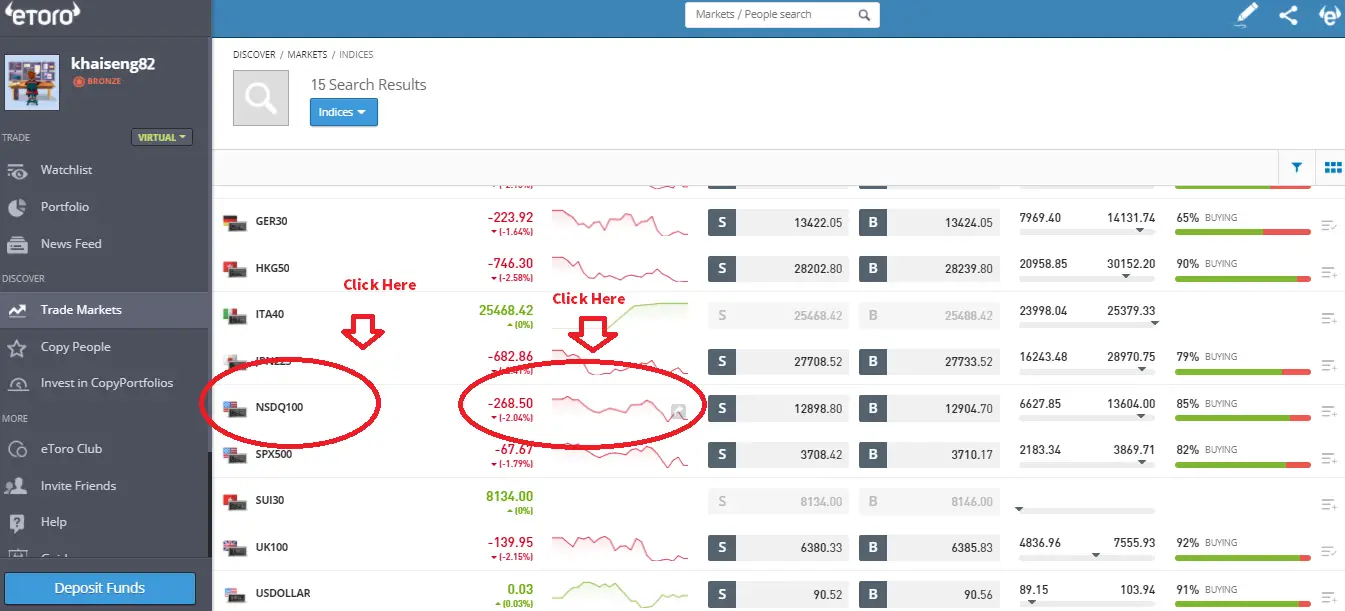

After you Click View All , it will bring you to the Indices Market Page

(1) Click the NSDQ100 Image

(2) Click the Graph Image

(3) Tile your Web Browser .

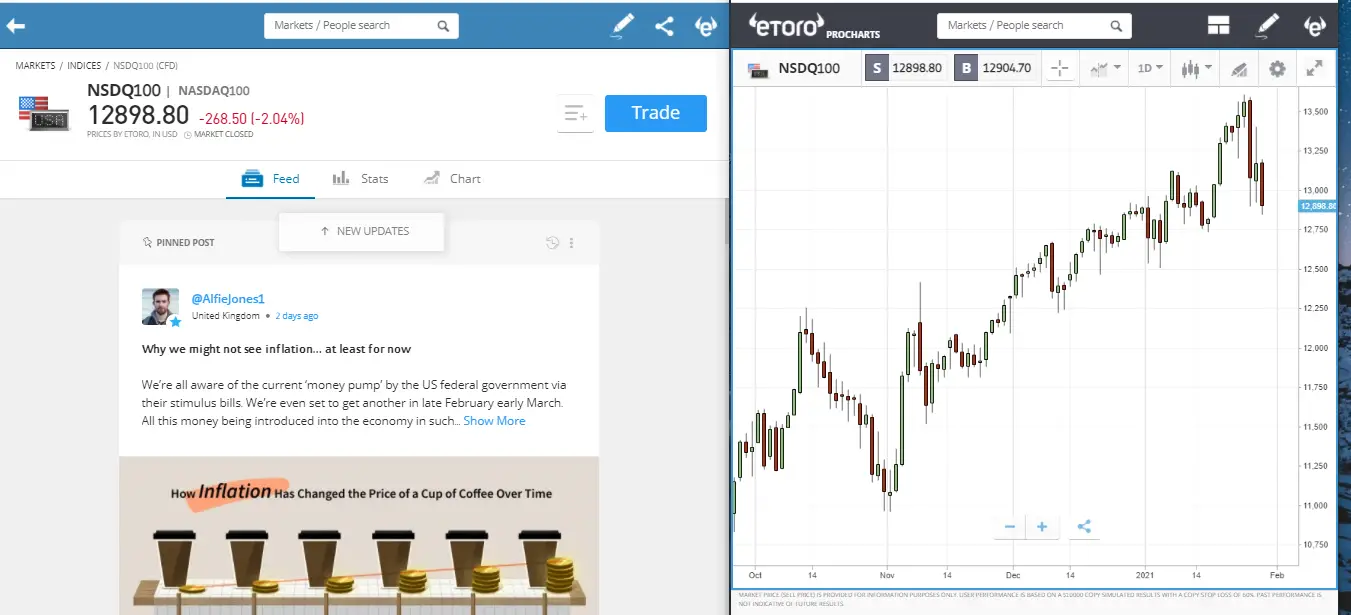

Normally for me when opening a trade , i would prefer to Tile my browser side by side so i have an Overview of the Price and control towards the action that i will be executing

Step 4

Do Some Calculation

or you can use a CFD Indices Calculator to Calculate

My Dummy Plan is as below

(1) Open Short Position : 12920

(2) Unit to Trade : 1 indices

(2) Take Profit : Indices Drop to 12820 Exit trade and Take Profit

(3) Stop Loss : Indices Rise to 13020 Exit trade Stop Loss

(4) Leverage : x 5 (Leverage 5 Time)

Some Calculation :

Calculate Margin Required to Deposit to Open a Short Position

Margin Required :

Contract Size = 1 unit Bought x 12920

= USD 12920

Leverage applied = 5

Margin Required = USD 12920 / 5

= USD 2584

Calculate Take Profit

(1) You Borrow 1 Unit Of NSDQ100 Indices and sell it at a Price of USD 12920

(2) When the Indices Drop to your target Numerical Number 12820 , the System will help you buy back 1 Unit Of NSDQ100 Indices at Price USD 12820 , and return to Etoro

(3) Indices Difference = 12920 – 12820 = 100 indices( Different ) (Positive)

(4) Your Contract Size = 1 Unit

(5) 1 Indices = 1 USD

(6) Take Profit = 100 indices x 1 = USD100 (Profit)

Calculate Stop Loss

(1) You Borrow 1 Unit Of NSDQ100 Indices and sell it at a Price of USD 12920

(2) Unfortunately the Indices Rise to 13020 , the System will help you buy back 1 Unit Of NSDQ100 Indices at Price USD 13020 , and return to Etoro

(3) Indices Difference = 12920 – 13020 = – 100 indices( Different )( Negative)

(4) Your Contract Size = 1 Unit

(5) 1 Indices = 1 USD

(6) Take Profit = -100 indices x 1 = USD100( Loss)

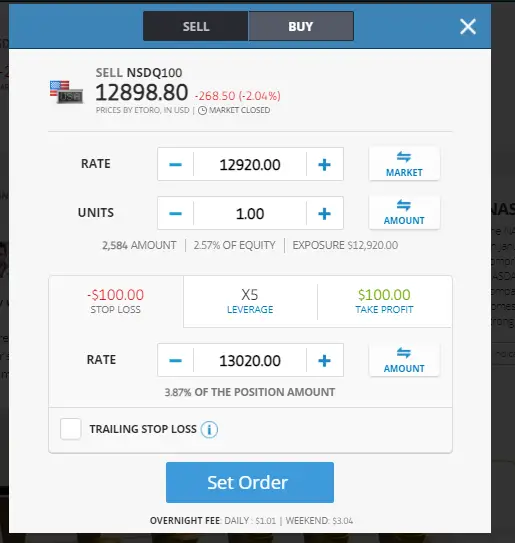

Step 5

Open your Short Position Base on your trading Plan

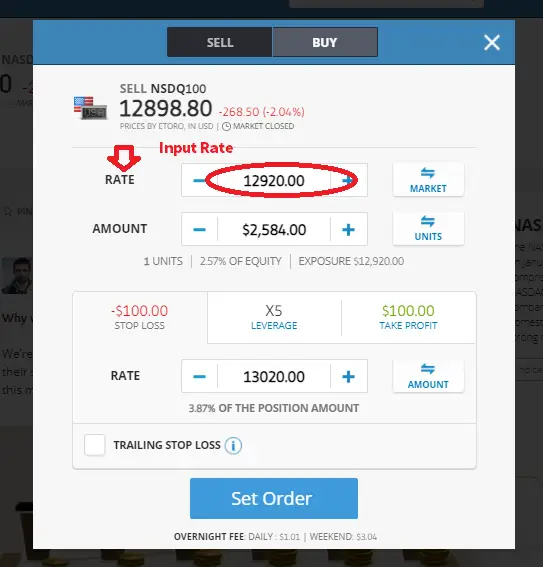

(1) Click Sell

(2) Click Order

(3) Set Rate according to your Trading Plan , in this Example is 12920

Set The Number of Units you want to Trade

(1) On your right hand Side Click the Unit Button

(2) Make sure after you click the Unit Button , the Label on your right hand side display as unit

(3) Input the number of unit , in this case example is 1 unit

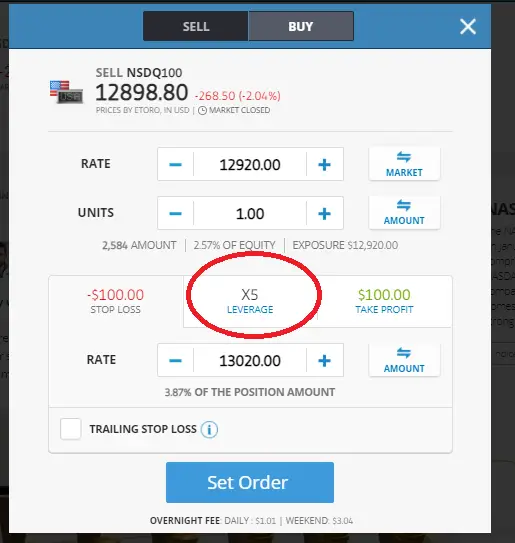

Set Leverage

(1) Click the Leverage Tab

(2) Select the Number of Leverage you want ,In this case example leverage is set to 5

Note: More Leverage means more amplified Profit in contrast means more amplified Losses as well

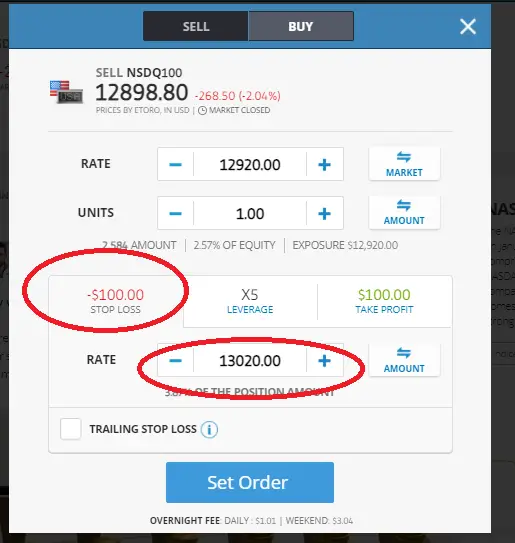

Set Stop Loss

(1) Click the Stop Loss Tab

(2) Click Rate Button on your right hand side, after you click the rate button , please make sure that the Label on your left hand Side display as Rate

(3) Input your Stop Loss Price , in this Case Example is 13020

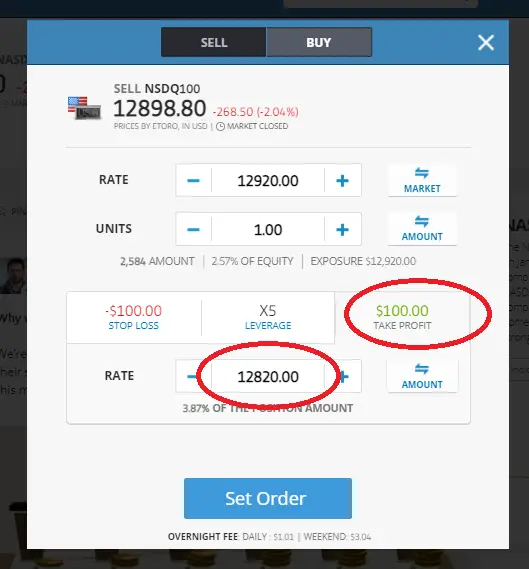

Set Take Profit

(1) Click the Take Profit Tab

(2) Click Rate Button on your right hand side, after you click the rate button , please make sure that the Label on your left hand Side display as Rate

(3) Input your Take Profit Price , in this Case Example is 12820

Step 6

Click the “Set Order “ Button

After you have done all your Setting , double Check and Click Set Order

When the Price hit your Set Order 12920

The System will execute a Short Sell Position