Tenancy Agreement Stamp Duty Calculator Malaysia

Tenancy Agreement Stamp Duty Calculator Malaysia. When we signed a tenancy agreement in Malaysia, the Tenant is required to pay Stamp Duty as a form of tax to the government.

The Web App below will assist you to calculate Stamp Duty Payable , Legal Fee Payable and estimated Admin Fee Payable. The Calculation is base upon Monthly Rental and period of Rental signed in the Tenancy Agreement.

Malaysia Tenancy Agreement Stamp Duty Calculator

Monthly Rental (RM)

Tenancy Period

Legal Fee Payable (RM)

Admin Fee Payable ( Estimation Only Up to Landlord / Agent) (RM)

Stamp Duty Payable (RM)

Rental Stamp Duty Calculation Guide Line as below

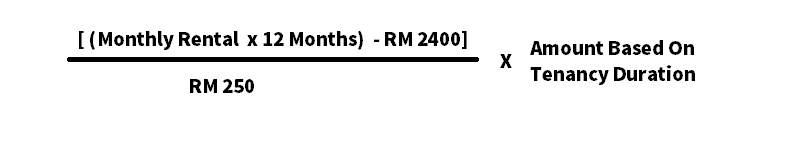

Stamp Duty Tax is calculated base on Multiple of RM 250.

The Numerical Multiplication to the multiple of RM250 are base on Number of period the Tenancy Agreement signed.

Refer the Table below

| Tenancy Duration | Amount |

| Less Than 1 Year | RM 1 |

| 1 Year to 3 Year | RM 2 |

| More Than 3 Year | RM 4 |

How To Calculate Rental Stamp Duty in Malaysia

Manual Calculation Formulae as below or you can use the above Tenancy Agreement Stamp Duty Calculator Malaysia to help you calculate

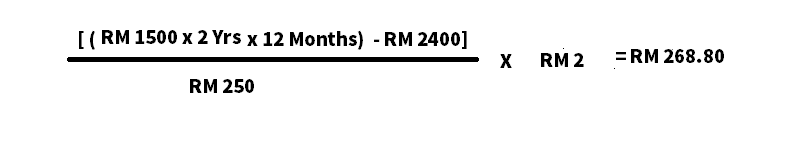

For Example :

Your Monthly Rental = RM 1500

Tenancy Duration = 2 Years

** The Tenancy Duration Falls into Category 2

Calculation as below

How Much you will need to Pay for Administration Fee

Beside paying Stamp duty , Tenant may need to pay admin Fee as well

Admin Fee is a one time payment , to be paid after the sign of tenancy Agreement to process Paper work. The Amount can be negotiable with Landlord and Agent

Below Table show the estimated amount of Admin Fee base on Monthly Rental Amount.

or you can use Tenancy Agreement Stamp Duty Calculator Malaysia to Calculate

| Rental Per Month | Admin Fee Amount |

| < RM1,000 | RM100 |

| RM1,000 to RM1,999 | RM150 |

| RM2,000 to RM3,000 | RM200 |

| RM3,000 to RM4,000 | RM250 |

| More Than Rm4000 | RM300 |

Check Out Singapore Rental Stamp Duty Calculator Here